But it also means you can. Ad Find The Best Deal On Your Next Car.

How I Got Duped Buying My First Car And How I M Recovering Car Cars Carbuying Carpurchases Usedcar Usedc Car Buying Tips Buying Your First Car Car Buying

Get 3-Year36000-Mile Hyundai Complimentary Maintenance When You Buy A New Hyundai.

. Ad CARFAX Has Thousands Of Listings With Great Deals Available Near You. Ad Get Americas Best Warranty. Can I sell my home while in forbearance.

Find the Car That Is Right For You. While to be safe I would wait til final docs are signed my mortgage broker told me I was free to buy and spend just as soon as the final credit check was done 2-3 days before. Minimum FHA Credit Score Requirement Falls 60 Points October 11.

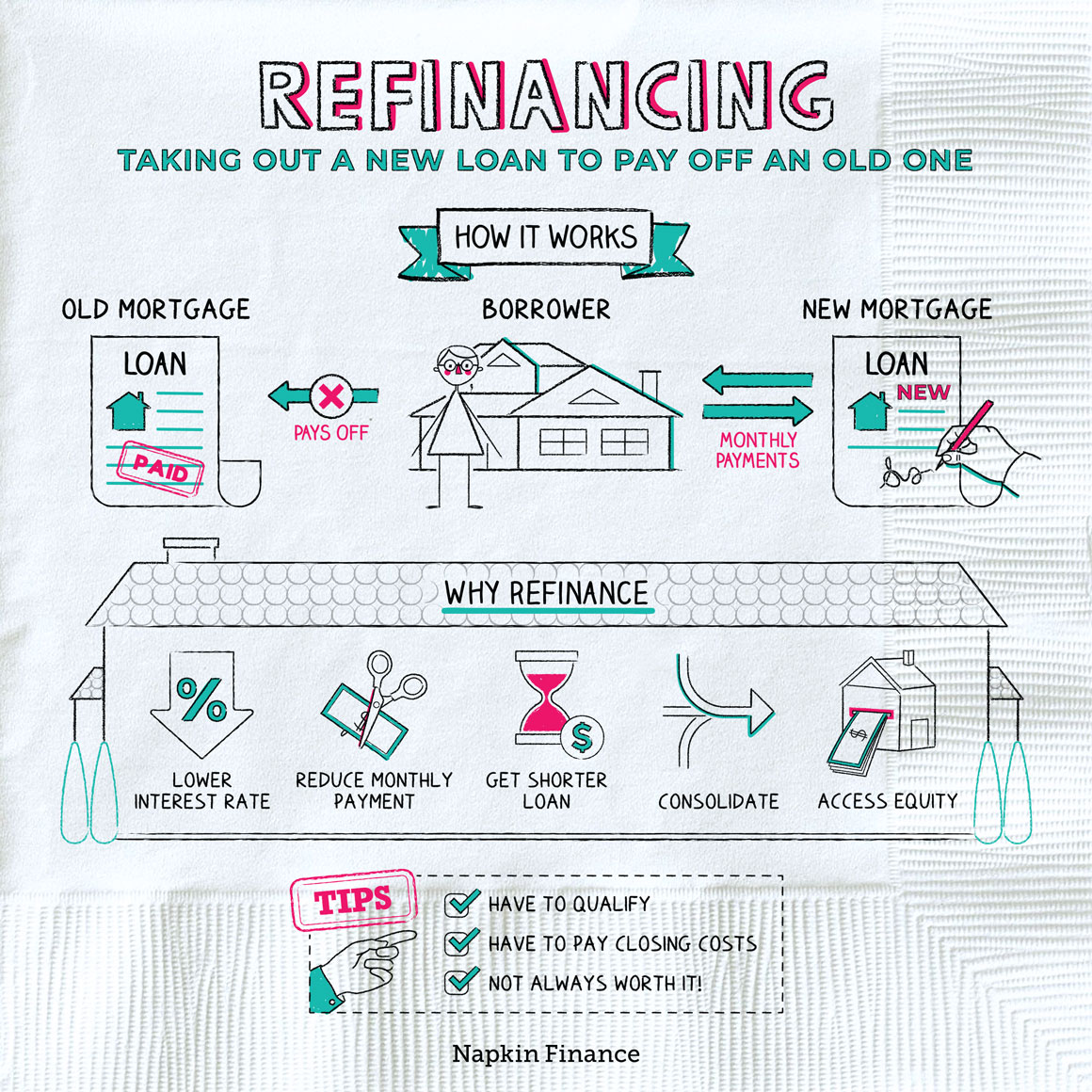

Your home and car are likely your two largest expenses. Monthly payments on 20000 released through 30-year cash-out refinance at 5 percent. I would not use a cash out refinance to do so.

There is no reason for me to refinance your house. Ad Ready to Begin. We can help you get an auto loan regardless of your current credit situation.

But your good FICO score low debt to income ratio and income may support an additional amount of debt. Because not only are you looking to borrow a large sum of. Well Help You Find A Home Loan.

Auto Approve is the ideal way to get out of your high-interest auto loan. Refinancing while separated more complicated If you refinance after filing for divorce. Once you have that new.

The refinance of the car will impact your credit score as if you have purchased a new car. That lower rate assuming all other factors are equal means you pay less for your car after. When a lender evaluates you for a home loan it looks for a range of information about you your finances and your ability to repay the debt.

10-Year100000-Mile Powertrain Limited Warranty. Can i buy a car while refinancing my house Should I wait to refinance my auto loan if I want to buy a house. The process will differ depending on your equity and you may have options to.

Your Guide To 2015 US. Answer 1 of 5. The ability to borrow at a lower interest rate is a primary reason to refinance a loan.

Refinancing can reduce the total amount you pay for your car if the new loan has a lower interest rate. Trusted by Over 1000000 Customers. Finish Your Used Car Search Here.

Learn about refinancing today. Browse Millions Of New Used Listings Now. Well Help You Find A Home Loan.

Save on Your Monthly Payments. If you live in an area where real estate values are high purchasing a home may be unattainable as a first-time buyer on an entry-level salary. Ad Click Now Choose The Best Auto Loan Refinancing Service For You.

Because car loans can reach tens of thousands of dollars even a difference. In general bankruptcy debtors may not enter into major transactions such as buying a car or refinancing a house without the bankruptcy trustees or. Credit scoring favors established older debt over new debt.

Answer 1 of 2. Homeowner Tax Deductions. Most likely payment terms will be extended from the remaining years on your loan to a new 30-year term.

Ad Why are you paying more than you need to for your car loan. But multiple big-ticket debts like cars and homes can signal to lenders that youre in danger of overextending your finances. Youre planning to buy a home before your car is paid off but you also expect your income to increase.

I had no problem buying a car while financing my house. It depends on your financial situation whether you can buy a car. Closing costs will be amortized over the course of the new loan.

Expert Reviews Analysis. Often the answer to the question. You can sell your house while in forbearance.

Ad Ready to Begin. Some lenders wont refinance a car loan until it has been open six. It also looks at your debt-to-income.

Ad Well focus on your potential to repay and find a monthly loan payment that works for you. Most cars depreciate in value very quickly so buying a one- or two-year-old used car can save you between 5000 and 15000 assuming the car cost 25000 new. Buying a car while refinancing.

If youre looking for a way to save money you may be wondering if you can refinance your mortgage and auto loan at the. Strictly speaking you can refinance a car loan as soon as you find a lender that will approve the new loan. Monthly payments on 20000 5-year car loan at 5 percent.

If you buy a car that costs 400 a month thats 4800 per year.

Loan Refinance Refinancing A Mortgage When Can I Refinance My House Infographic

5 Things I Ve Learned From Refinancing My Mortgage

Should I Refinance My Car Loan Or Mortgage First Rategenius

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

Loan Refinance Refinancing A Mortgage When Can I Refinance My House Infographic

Should I Refinance My Car Loan Before Buying A House Rategenius

/Investopedia-terms-cash_out-refinance-V2-9b3bb93322934719ab4c5cfec6335f27.png)

0 comments

Post a Comment